The 4 Buckets of Company Growth

Will your company succeed?

Today, I want to present a simple model of startup company growth and offer your company advice tailored to where you are in this model.

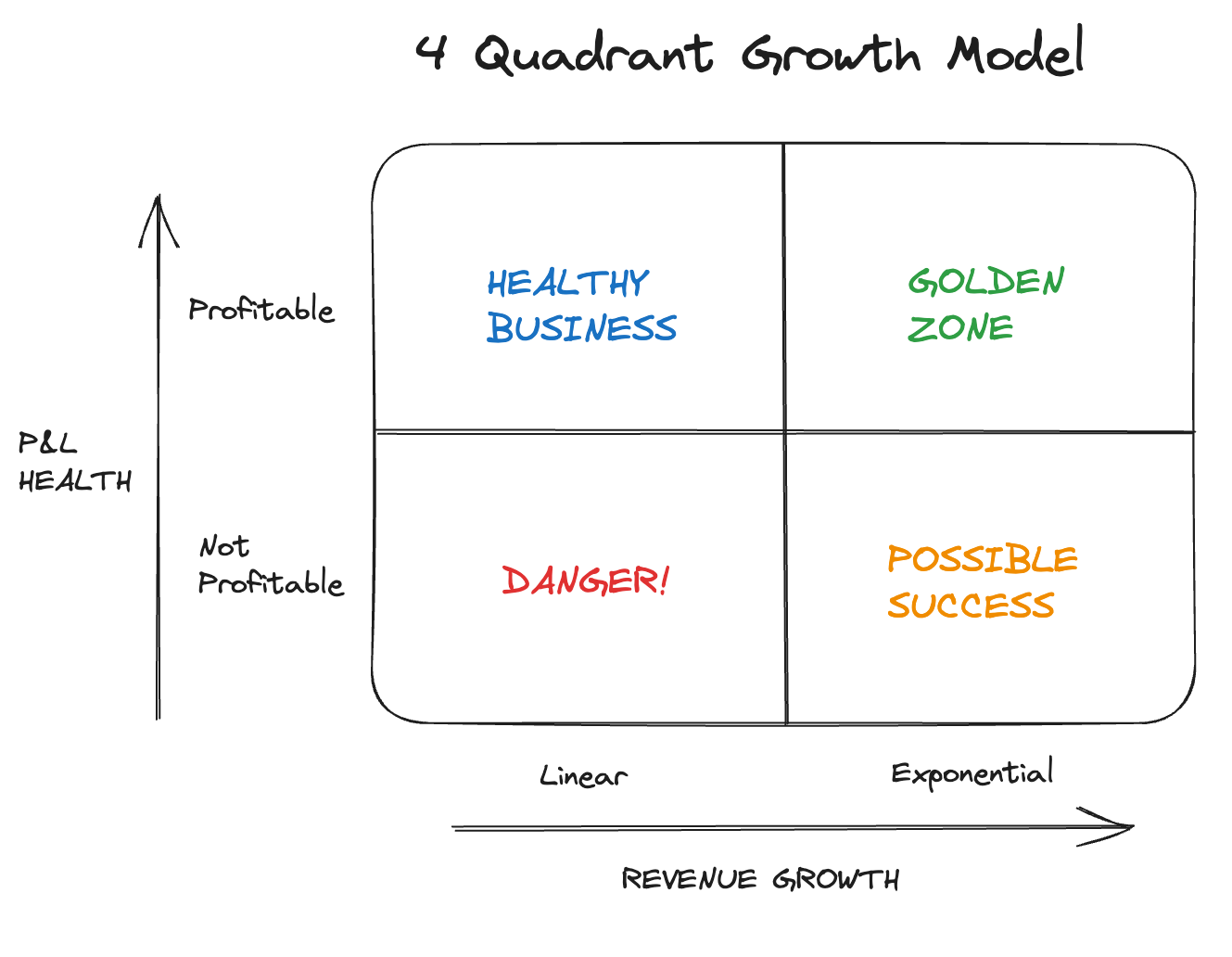

The 4 Quadrant Growth Model

Below is a simple model that compares a startup company’s Revenue Growth and its Profitability.

Before I talk about each quadrant, let me be more precise about the revenue growth axis. Below are two hypothetical startup companies. The first grows an average of 24% per year over 10 years. At Year 10, they’re making a little over $4M in revenue. The second doubles revenue each year. At Year 10, they’re over $500M in revenue. While not strictly “exponential” in mathematical terms, the second chart is the much-coveted “hockey stick” growth.

These two examples are extremes, and no startup follows either model purely. But, it’s critical for founders to assess the type of growth they’re having and adjust accordingly. Now I’ll define quadrants and then talk about what happens if you get stuck in one of them.

Case 1: Non-profitable startups with linear growth

This is where all companies start. Some startups bootstrap with angel funding. Others emerge from an accelerator program like YC. Others get “belief capital” pre-seed investment. A startup can’t stay in this quadrant, of course, so let’s talk about exit vectors, all of which are paths to company success.

Exit vector A —> Exponential Revenue Growth — This is the preferred growth direction early on because it represents market traction, and profitability can come after you’ve hit a tipping point in market penetration. Investors typically want you to capture as much of the market as you can as fast as you can.

Exit vector B —> Profitability — In my personal experience, this vector is often associated with bootstrapped startups that began with a scarcity mindset on spending. The philosophy is that a startup’s revenue should fund its expansion, so the company focuses on early profitability and then expands only as revenue expands.

Exit vector C —> Exponential Revenue Growth & Profitability — This vector is amazing if you can go straight to it from the lower left, especially if you’re able to sustain exponential growth over a long period. Realistically, this vector is reserved for startups like TikTok.

Case 2: Non-profitable startups with exponential growth

As mentioned, this is preferred by investors because they want you to quickly capture as much of your market as possible. In fact, many startups get acquired or IPO for large valuations while still being unprofitable. In boom times, valuations for these companies are usually staggering, with multiples of 20x or higher. Prior to the current recession we’re in, most startups aspired to this quadrant and hoped for these valuations/multiples.

However, once you go public or get acquired, the clock starts ticking on getting to profitability. And if you don’t, eventually either your acquiring company or Wall Street will demand that you downsize expenses (e.g. layoffs and divested products). If you get acquired by a PE firm, it will be an even faster clock.

Case 3: Profitable startups with linear growth

I’ve been in a couple of startups in this bucket. Generally speaking, they were bootstrapped and had a dominant philosophy of “don’t spend more than you take in revenue.” They adopted this philosophy very early on in their company culture because they reached profitability fairly quickly.

By definition, these are successful companies because they are profitable and sustainable. For me, they ranged in valuation from $50M to $multi-B.

However, there is a danger of creating a lifestyle business that doesn’t reach its full potential. There is also a risk of insular thinking. For example, if a startup is profitable early and grows linearly, it’s likely they haven’t taken much funding and therefore don’t have an external Board of Directors staffed with experienced operators. A lack of external thinking is an impediment to reaching a company’s full potential.

Case 4: Profitable startups with exponential growth

I’ve never been a part of a startup that got to this quadrant early. I mentioned TikTok as a good example of a company that grew staggeringly fast in both users/revenue and profitability. This is the golden quadrant…the holy grail. Every startup that wants to be a long-lived company like Apple, Alphabet, Netflix, Amazon, etc. will aspire to get to this quadrant early on in order to get market domination.

That said, the bigger a company gets, the harder it is to stay in this quadrant for any length of time. Realistically, revenue growth just can’t keep up, and bigger companies move to profitability and linear growth.

What happens if a startup gets stuck?

Ignoring the TikToks of the world, since there are so few of them, it takes 10+ years for a startup to see real success in my experience, where “real success” is > $50M in ARR. Time not spent in the Golden Quadrant is often measured in years and in many rounds of funding.

Because of this, I don’t think it’s helpful to put a specific timeframe on any particular quadrant. However, I want to describe what being permanently stuck in a quadrant looks like.

Case 1: Non-profitable, linear growth: Never exiting the lower left quadrant will eventually result in company death. It might be an acquisition, but it won’t be a lucrative one. It might be an acquihire (acquiring the people), which is good for some of the people, but not investors. It might be an asset sale (acquiring the physical and intellectual assets, but not the equity), which won’t be lucrative. It might be closing up shop completely. 😔

I’ve been in this situation twice. In one case, the company received a lot of sustaining funding (i.e. “belief capital”) and stayed in this quadrant for almost 10 years, long after I had left. It was acquired for assets, and no one made any money. The second company folded, and again no one made any money.

Case 2: Non-profitable, exponential growth: As mentioned, staying in the lower right quadrant without an impending IPO or acquisition will result in continued funding rounds designed to increase market penetration. My experience is that these companies are pushed to keep growing in staffing and product offerings in order to get as big as possible as fast as possible. Investors are still expecting a solid exit. Eventually, though, either an exit must occur or the company must move to profitability to sustain itself.

I’ve been in this situation once. At its peak, the company was over $2B in valuation, with several large funding rounds, but its market penetration peaked and growth stalled. The company had to downsize to profitability.

Case 3: Profitable, linear growth: Finally, staying in the upper left generally means a company can operate indefinitely. I’ve personally seen a huge range of valuations in this quadrant, ranging from $50M to $5B. That said, there is a danger of creating a lifestyle business, and there is a danger of not seeking external thinking to help a company reach its full potential. More on that below.

HELP! We’re stuck!

OK, if you’ve made it this far, you might be concerned that you’re been in one of these quadrants too long. Here’s some advice, but please reach out if you want to talk more about your specific startup.

Case 3: Profitable, linear growth: Good for you…maybe.

If you’re $1-10M in ARR, you need to figure out how to a) increase your pricing, b) increase your TAM, c) increase the number of customers, and/or d) expand your product. If you don’t do this, you’ll become a lifestyle business that may or may not last.

If you’re $10-100M in ARR, welcome to the slog of sustaining growth and puzzling over why you can’t get growth to move beyond linear. I assume you want to be a unicorn ($1B+ valuation), so please get some external thinking from outside Board members, outside executives, and outside advisors. Don’t fall into insular patterns! Most likely you’ll need to become a multi-product company. Most likely you’ll need new sales motions. You may need to do some M&A to expand.

If you’re greater than $100M in this quadrant, you almost certainly need hyper-growth and a multi-product strategy to move outside of linear growth.

Case 2: Non-profitable, exponential growth: Good for you…maybe!

If you’re $1-10M in ARR, don’t start celebrating. You have a long way to go. Your raw customer numbers are small relative to your TAM. So, figure out the sources of your exponential growth and double down. Conduct lots of different experiments for customer acquisition and retention.

If you’re $10-100M in ARR, you’re likely tempted to go into hyper-growth if you’re not already there. Hyper-growth is absolutely the bet to make in order to dominate your market. However, hyper-growth is very difficult. Make sure you have a solid plan on how to execute with a massive staffing increase. Make sure you have experienced leaders who have shepherded this speed of growth. It’s very easy to lose focus, execution speed, company culture, and many other things.

If you’re greater than $100M ARR, why aren’t you profitable? 😉 I understand that there are some startups with very high operating and manufacturing costs, e.g. SpaceX, medical device companies, etc. But those companies are not exponential growth companies, so if this is you, I’d love to learn more about your specific case.

Case 1: Non-profitable, linear growth: It’s okay! You just haven’t crossed the chasm yet.

You are where hundreds of thousands of other startup companies are currently. Don’t give up! Today’s economy is tough, but it won’t last. Keep waking up every day obsessing about your customers, obsessing about your market, and obsessing about your product. I mean, this is why you started the company in the first place, right?!

Hey Doug great post, WRT too external influence... "therefore don’t have an external Board of Directors staffed with experienced operators. A lack of external thinking is an impediment to reaching a company’s full potential."

From your experience what are the top 2 ways a company attracts/recruits great board members?